Ultimate Guide to Forex Trading: Strategies, Platforms, and Tips

Forex trading, also known as foreign exchange trading, is one of the largest and most liquid financial markets in the world. It involves the buying and selling of currencies with the aim of making a profit. In this guide, we will explore various aspects of Forex trading, including strategies, platforms, and crucial tips to help you navigate this dynamic market. If you’re looking for a reliable trading platform, consider forex trading site kuwait-tradingplatform.com, which offers a user-friendly interface and a variety of tools for traders of all experience levels.

What is Forex Trading?

Forex trading takes place on a global scale, involving different participants, including banks, financial institutions, corporations, and retail traders. Unlike equity markets, Forex operates 24 hours a day, five days a week, allowing traders from different time zones to participate. The primary goal of Forex trading is to capitalize on currency price fluctuations. These fluctuations are influenced by numerous factors including economic indicators, geopolitical events, and market sentiment.

Understanding Currency Pairs

In Forex, currencies are traded in pairs. A currency pair consists of a base currency and a quote currency. For example, in the pair EUR/USD, the Euro (EUR) is the base currency, while the US Dollar (USD) is the quote currency. The price of this currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding currency pairs is fundamental to Forex trading as it helps traders determine potential profits or losses on their trades.

The Role of Leverage in Forex Trading

Leverage is a critical feature of Forex trading that allows traders to control a larger position with a smaller amount of capital. For instance, with a leverage ratio of 100:1, a trader can control a position worth $100,000 with just $1,000 of their own funds. While leverage can magnify profits, it also increases the risk of substantial losses. Therefore, it’s essential for traders to understand how to manage their leverage to minimize risks effectively.

Key Trading Strategies

There are several trading strategies that Forex traders employ to maximize their potential for profit. Here are some of the most popular ones:

- Scalping: This strategy involves making numerous trades throughout the day, aiming to profit from small price changes.

- Day Trading: Day traders open and close positions within the same trading day to prevent exposure to overnight risks.

- Swing Trading: Swing traders hold positions for several days or weeks, seeking to capture larger price swings.

- Position Trading: This long-term strategy involves holding trades for weeks or months, capitalizing on long-term market trends.

Selecting a Forex Trading Platform

The choice of a trading platform is crucial for your Forex trading success. A good trading platform should offer a user-friendly interface, a variety of trading tools, and excellent customer support. In addition, it’s important to check whether the platform provides educational resources and analysis tools that can help you make informed trading decisions. For instance, kuwait-tradingplatform.com offers an intuitive trading interface along with various analytical tools designed to assist traders at all levels.

Risk Management in Forex Trading

Effective risk management is vital in Forex trading to protect your capital. Here are some essential risk management strategies:

- Use Stop-Loss Orders: This order automatically closes a position when the market price reaches a specified level, helping to limit losses.

- Set Risk-Reward Ratios: A good rule of thumb is to aim for a risk-reward ratio of at least 1:2, meaning you should aim to make twice as much as you’re willing to risk.

- Diversify Your Portfolio: Avoid putting all your capital into one trade. Diversifying across various currency pairs can help spread risk.

The Importance of Analysis in Forex Trading

Traders can use two main types of analysis to inform their trading decisions: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, central bank policies, political events, and other financial factors that might affect currency values. Key indicators include interest rates, GDP growth, employment data, and inflation rates. This analysis helps traders understand the underlying factors that can impact currency movements.

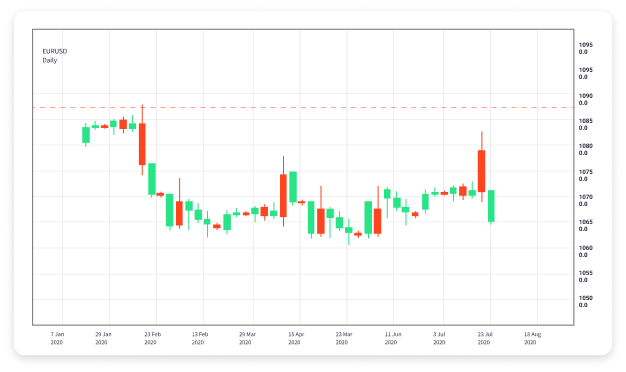

Technical Analysis

On the other hand, technical analysis focuses on price movements and market trends. Traders using this analysis rely on chart patterns, indicators, and historical price data to predict future price movements. Common tools include moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels.

Tips for Success in Forex Trading

Becoming a successful Forex trader requires dedication, discipline, and continuous learning. Here are some tips to help you succeed:

- Educate Yourself: Invest time in learning about Forex trading through books, online courses, and webinars.

- Start with a Demo Account: Practice your trading strategies on a demo account before risking real money.

- Trade with a Plan: Develop a trading plan that outlines your goals, strategies, and risk management rules.

- Stay Informed: Keep up-to-date with market news and economic calendars to understand events that may affect your trades.

Conclusion

Forex trading offers substantial opportunities for profit, but it also comes with significant risks. By understanding the fundamentals, employing effective trading strategies, practicing sound risk management, and selecting the right trading platform, you can increase your chances of success. Consider exploring resources available at platforms like kuwait-tradingplatform.com to enhance your trading journey.