The Benefits of Forex Trading: Why You Should Consider It

Forex trading is a financial market that presents various opportunities for traders worldwide. With a daily trading volume exceeding $6 trillion, the forex market is the largest and most liquid financial market globally. This article will delve into the numerous benefits of forex trading, illustrating why it’s a viable option for both novice and experienced traders. To begin, let’s explore the high liquidity of the forex market, which offers unique advantages for participants. Forex trading is accessible to anyone with an internet connection and those interested can start trade with a relatively low initial investment. For those eager to learn more about forex trading strategies, you can visit forex trading benefits Trading BD.

1. High Liquidity

One of the primary advantages of forex trading is its high liquidity. High liquidity means that traders can enter and exit positions with ease, as there are countless buyers and sellers in the market at any given time. This feature ensures minimal price slippage and allows for more precise trading. Additionally, high liquidity often results in tighter bid-ask spreads, which can save traders money in transaction costs. Consequently, whether you are a day trader looking for quick moves or a swing trader intending to hold for a more extended period, high liquidity can complement your trading style effectively.

2. Accessibility and Convenience

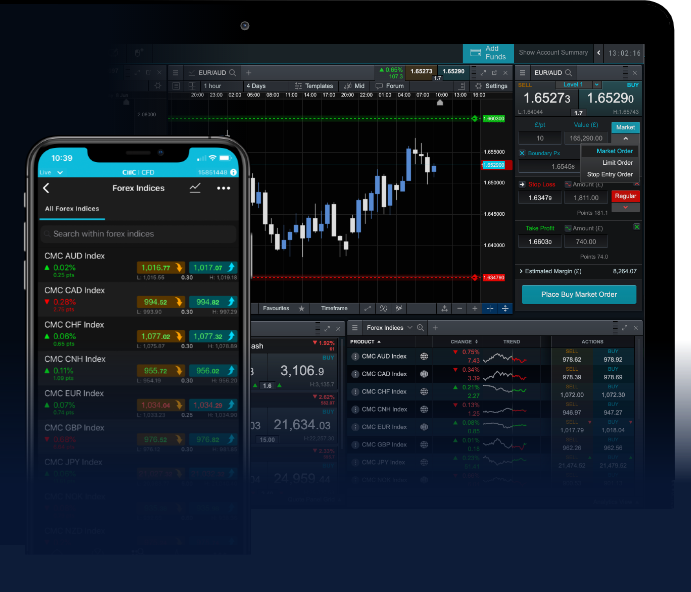

Forex trading is incredibly accessible. Unlike traditional stock markets where trading hours are limited, the forex market operates 24 hours a day, five days a week. This flexibility allows traders to engage in the market at their convenience, fitting trading around personal and professional commitments. Additionally, the entry barrier for participating in forex trading is significantly lower than in other markets. Many brokers offer accounts with minimal initial deposits, making it feasible for beginners to start trading without substantial capital. The proliferation of mobile trading apps also allows traders to manage their positions on the go, ensuring they never miss out on potential market opportunities.

3. Wide Variety of Trading Options

Forex trading offers a vast range of currency pairs to choose from, including major, minor, and exotic pairs. This variety allows traders to diversify their portfolios and explore different market dynamics. Currency pairs are often influenced by various economic factors, geopolitical events, and market sentiment, providing traders with numerous strategies to execute based on their market analysis. Furthermore, many platforms offer additional trading instruments such as commodities, indices, and cryptocurrencies, all available under the same account. This means that traders can expand their horizons and utilize different trading strategies across multiple asset classes.

4. High Leverage

Another significant benefit of forex trading is the availability of high leverage options. Many forex brokers offer leverage ratios that can reach up to 1:500 or even higher, depending on the regulations of the broker’s jurisdiction. This means traders can control a considerable amount of capital with a relatively small amount of money. For example, with a leverage ratio of 1:100, a trader can control $100,000 with only $1,000 in their trading account. While leverage can magnify potential profits, it’s essential to understand the risks involved, as it can also amplify losses. Consequently, responsible risk management practices are vital for successful trading.

5. Potential for High Returns

The forex market offers substantial profit potential due to its volatility and leverage. Profit opportunities arise from daily fluctuations in currency exchange rates. Traders can take advantage of these price movements, whether in an upward or downward direction. This characteristic makes forex trading appealing to those looking for quick returns. Many traders employ various trading strategies, from scalping to swing trading, to maximize their profits. However, it’s important to approach trading with a well-thought-out plan and a clear understanding of market trends to improve the probability of success.

6. Influence of Global Events

The forex market is highly influenced by global economic and political events. This makes it an excellent space for traders who enjoy staying informed about global affairs. Economic indicators such as GDP, employment data, and interest rates significantly impact currency values. Traders who track these data releases and geopolitical events can capitalize on market movements that result from them. With an understanding of fundamental analysis, traders can develop strategies that leverage these events to their advantage, further enhancing their likelihood of success.

7. Learning Opportunities

Another benefit of forex trading is the wealth of educational resources available. From training seminars to online courses, forums, and webinars, traders can access a bounty of information that can aid their trading journey. Many brokers provide demo accounts that allow new traders to practice their strategies without risking real money. This risk-free environment is crucial for developing trading skills and understanding market dynamics. As traders gain experience, they can refine their strategies and build their confidence, which is essential for long-term success in the forex market.

8. No Commissions

Unlike stock trading, where brokers often charge a commission for each trade, forex trading typically operates on a spread basis. This means that traders pay the difference between the buying and selling prices of a currency pair. Many forex brokers do not charge commissions on trades, which can be advantageous for those looking to trade frequently. Eliminating commission fees can significantly reduce overall trading costs, allowing traders to retain more of their profits. Understanding these cost structures can help traders select the right broker to maximize their earnings potential.

Conclusion

In summary, forex trading offers numerous benefits, making it an attractive option for individuals looking to invest in financial markets. Its high liquidity, accessibility, and potential for high returns make it accessible to a diverse range of traders. However, it is crucial to approach forex trading with a well-informed strategy and a commitment to risk management. As with any form of trading, knowledge is power. By taking advantage of available resources and staying informed about market trends, traders can navigate the forex market successfully and work toward achieving their financial goals.