Effective Forex Day Trading Strategies for Maximum Profit

If you’re looking to dive into the exciting world of Forex trading, understanding effective day trading strategies is essential. Day trading in the Forex market involves buying and selling currency pairs within a single trading day, and it requires a combination of skill, knowledge, and discipline. To excel, you might want to explore resources like forex day trading strategy Crypto Trading Asia to get insights and tools that could enhance your trading experience. In this article, we will discuss various day trading strategies, their advantages, and how you can implement them successfully.

Understanding Forex Day Trading

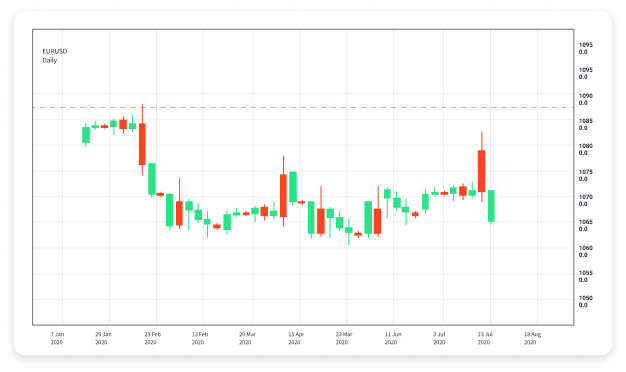

Forex day trading is distinct from long-term investing. It focuses on short-term price movements, with traders aiming to capitalize on small fluctuations in currency pairs. This strategy requires quick decision-making and the ability to analyze market trends efficiently. Here are some key elements of successful Forex day trading:

- Market knowledge: Understanding how economic events and market sentiment impact currency fluctuations is crucial.

- Technical analysis: Utilizing charts and indicators to identify potential trading opportunities.

- Risk management: Setting stop-loss and take-profit orders to minimize potential losses and protect gains.

Popular Forex Day Trading Strategies

While there are countless strategies traders use in the Forex market, here are a few popular ones that can significantly enhance your trading success:

1. Scalping

Scalping is a popular day trading strategy that involves making rapid trades to capture small price movements. Traders typically hold positions for seconds to minutes and aim to make a series of small profits throughout the day.

Benefits of Scalping:

- Quick returns on investment.

- Reduced exposure to market risks, as trades do not last long.

However, scalping requires intense focus and a reliable trading platform that allows for fast executions.

2. Momentum Trading

This strategy involves identifying and trading on trends in a particular currency pair. Traders look for strong upward or downward movements and enter positions in the direction of the trend.

Key indicators for momentum trading include:

- Moving Averages (MA): To determine the trend direction.

- Relative Strength Index (RSI): To identify overbought or oversold conditions.

One method is to enter a trade when the price breaks through a significant resistance level or falls below a support level.

3. Range Trading

In range trading, the goal is to buy at the support level and sell at the resistance level. This strategy works best in a market that is not trending and is instead moving sideways.

Essential tools for range trading:

- Support and resistance lines: Clearly define levels where price reversals may occur.

- Volume indicators: To confirm potential reversals or breakouts.

Traders can set entry and exit points based on previous highs and lows while maintaining strict stop-loss levels to manage risks.

Implementing Your Day Trading Strategy

To successfully execute your day trading strategy, consider the following steps:

1. Develop a Trading Plan

Define your trading strategy, including specific entry and exit points, risk tolerance, and profit goals. A well-structured trading plan acts as a roadmap, helping you stay disciplined under pressure.

2. Use Real-Time Data

Access to real-time data is vital for day traders. Utilize advanced charting software and trading platforms that provide instant insights into market dynamics.

3. Continuously Monitor and Analyze

The Forex market can change swiftly; monitoring your trades and market conditions continuously is necessary. Utilize situational analysis to adjust your plan based on real-time information.

4. Maintain Risk Management

However confident you may feel in your strategy, never risk more than you can afford to lose. Consistently apply risk management strategies to safeguard against significant losses.

Conclusion

Forex day trading is an exciting yet challenging endeavor that requires a solid understanding of market behavior and effective strategies. By mastering techniques such as scalping, momentum trading, and range trading, you can develop a comprehensive approach that maximizes gains while managing risks. Whether you’re a novice or a seasoned trader, always strive to improve, continuously learn, and adapt to changing market conditions. With the right strategies and mindset, you can find success in the fast-paced world of Forex day trading.

Remember, patience, discipline, and ongoing education can significantly impact your trading results. Start implementing these strategies today and experience the difference they can make in your Forex trading journey.