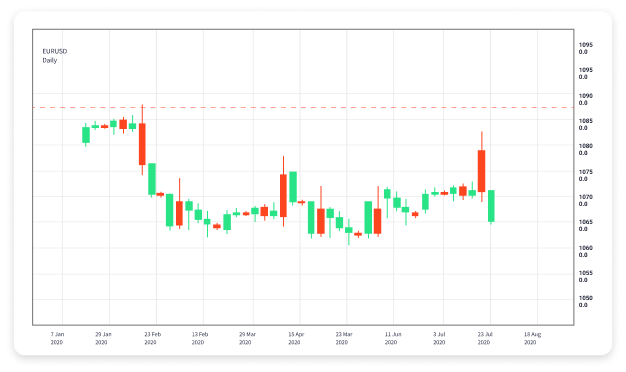

In the fast-paced world of Forex trading, having a reliable source of information can make all the difference between a successful trade and a costly mistake. Trading signals, which provide essential insights and recommendations based on market analysis, are one of the most valuable tools a trader can leverage. Whether you are a seasoned trader or a beginner looking to enhance your trading strategy, understanding Forex trading signals is vital.trading signals forex Trader APK offers a range of tools and resources to help traders navigate this complex market successfully.

What are Forex Trading Signals?

Forex trading signals are essentially trade recommendations based on various forms of analysis, including technical and fundamental analysis. These signals provide traders with specific entry and exit points for their trades, as well as the recommended stop-loss and take-profit levels.

Signals can be generated manually by experienced traders or automatically by analytical software. Regardless of the source, the primary goal remains the same: to help traders make informed decisions in a market that is notoriously volatile and unpredictable.

Types of Forex Trading Signals

There are generally two main types of Forex trading signals: manual and automated.

Manual Trading Signals

Manual trading signals are usually generated by professional traders or analysts who use their experience and market knowledge to identify potential trading opportunities. These signals might be disseminated through various platforms, such as newsletters, blogs, or via social media.

Traders who follow manual signals often benefit from the analyst’s insights and perspective on market trends. However, this method requires traders to do their own due diligence to validate the signals before acting on them.

Automated Trading Signals

Automated trading signals are generated by sophisticated algorithms and software, which analyze vast amounts of market data to find trading opportunities. These systems can operate in real-time, providing traders with up-to-minute information and alerts on potential trades.

While automated systems can help reduce human error and emotion, they can also carry risks if the algorithms are not properly designed or if market conditions change suddenly.

How to Use Forex Trading Signals

Utilizing Forex trading signals effectively requires a strategic approach. Here are some essential steps to consider:

1. Choose a Reputable Signal Provider

The first step in harnessing the power of trading signals is to select a trustworthy signal provider. Research online, read reviews, and check their track record before making a decision. Look for providers that offer transparency regarding their performance metrics.

2. Understand the Signal Type

Once you have selected a signal provider, it’s important to understand the types of signals they offer. Familiarize yourself with their methodology to gauge whether their approach aligns with your trading style. Some traders prefer short-term signals, while others may focus on long-term trends.

3. Use Signals as a Supplement

Forex trading signals should not serve as the sole basis for making trading decisions. Instead, they should be used as a supplementary tool alongside your own analysis. Always conduct your own research and validate signals before executing trades.

4. Manage Risk

Every trader understands the importance of risk management. When acting on trading signals, ensure that you set appropriate stop-loss limits to protect your capital. Remember that no signal is infallible, and losses are a natural part of trading.

Benefits of Using Forex Trading Signals

Incorporating Forex trading signals into your trading strategy can provide several advantages:

1. Time Efficiency

Markets can change rapidly, and analyzing data can be time-consuming. Trading signals save time by providing pre-analyzed information that traders can act upon immediately.

2. Enhanced Decision Making

Trading signals offer objective, data-driven insight that can improve decision-making processes. This can be particularly beneficial for novice traders who may struggle with market analysis.

3. Learning Opportunities

For new traders, following signals can serve as a learning experience. Understanding why certain signals are given can deepen their market knowledge and improve their future trading strategies.

Potential Drawbacks of Forex Trading Signals

While trading signals can be highly beneficial, they are not without their challenges:

1. Reliability Concerns

Not every signal provider guarantees successful results. It is critical to monitor performance and remain wary of promise of unrealistic returns.

2. Over-reliance

Dependence on signals might hinder the development of personal trading skills. Traders should still engage in their own market analysis to enhance their trading acumen.

3. Cost

Many reliable signal services come with a subscription fee. Traders should weigh the potential benefits against the costs and decide if it’s a worthy investment for their trading journey.

Conclusion

Forex trading signals can act as a valuable resource in a trader’s toolkit. They offer insights that can help optimize trading strategies, enhance decision-making processes, and improve overall performance. By choosing reputable signal providers and using signals in conjunction with personal analysis, traders can increase their chances of success in the dynamic world of Forex trading.

As you embark on your trading journey, always remember to stay informed, be adaptable, and practice effective risk management. With careful consideration and a strategic approach, Forex trading signals can pave the way for profitable trading experiences.