Unlocking Success: A Deep Dive into Forex Trading Prop Firms

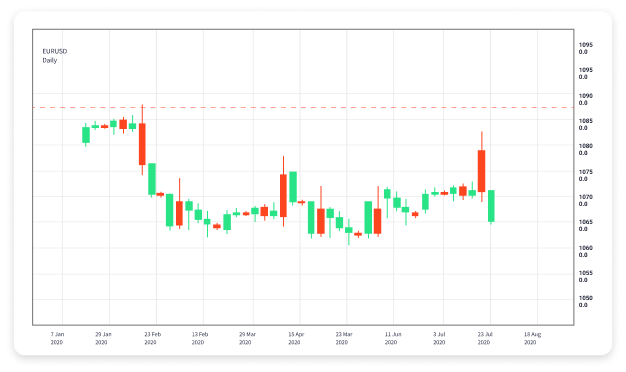

Forex trading has gained immense popularity in recent years, attracting a wide array of individuals from different backgrounds. Among the various options available for traders, Forex trading prop firms have emerged as a key player. These firms allow traders to access substantial capital to trade while providing the resources and support needed to succeed. In this article, we will explore what prop firms are, how they function, and the advantages they offer to aspiring forex traders. For an extensive guide on trading resources, you can visit forex trading prop firms https://trader-apk.com/.

Understanding Prop Firms

Proprietary trading firms, or prop firms, are financial companies that trade their own capital in various markets, including Forex. They hire traders to manage their funds with the expectation that a portion of the profits generated will be shared between the trader and the firm. Unlike traditional trading platforms where individuals trade their own money, prop firms provide an opportunity to trade using the firm’s capital, thus minimizing the financial risk borne by the trader.

How Prop Firms Operate

The operational model of a Forex trading prop firm generally involves several key components:

- Capital Provision: Prop firms supply traders with leverage, giving them access to substantial trading capital. This means that traders can execute trades much larger than their own investments would allow.

- Risk Management: Each firm has its own set of risk management rules, which traders must adhere to. This ensures that potential losses are managed effectively and that traders employ sound practices.

- Training and Support: Many prop firms offer extensive training programs, resources, and mentorship. These help traders improve their skills and develop strategies that align with the firm’s trading philosophy.

- Profit Sharing: The profits generated by the trader are typically split between the trader and the firm, with the specific ratio varying by firm. This creates an incentive for the trader to be successful.

Types of Traders in Prop Firms

Prop firms cater to a diverse range of traders, including:

- New Traders: Beginners who have the knowledge but lack the funds to trade can gain access to substantial capital through prop firms.

- Experienced Traders: Seasoned traders looking to scale their activities and increase their profit potential benefit from the additional capital.

- Algorithmic Traders: Traders who use automated trading systems can find prop firms that support their activities and provide the necessary infrastructure for algorithmic trading.

Advantages of Trading with Prop Firms

There are several advantages to trading with prop firms, making them an attractive option for many traders:

- Leverage: Prop firms often provide significant leverage, allowing traders to control larger positions without the need for large upfront capital. This can amplify potential gains, provided that trades are executed wisely.

- Reduced Financial Risk: Traders use the firm’s capital rather than their own, which minimizes their financial exposure. While losses may be incurred, personal funds remain intact.

- Access to Resources: Many prop firms offer valuable resources, such as trading platforms, tools, and research, that can enhance a trader’s effectiveness.

- Community and Networking: Joining a prop firm offers an opportunity to collaborate and network with other traders, share strategies, and learn from one another.

Challenges of Trading with Prop Firms

While prop firms offer many benefits, there are also challenges to consider:

- Cutthroat Competition: Many traders are vying for a limited pool of profits, leading to a competitive environment where traders must constantly perform at a high level.

- Strict Rules: Prop firms usually impose strict trading rules and risk management protocols that must be followed, which may not align with every trader’s style.

- Profit Sharing Structures: Traders typically have to share a portion of their profits, which might seem less appealing compared to trading independently.

Finding the Right Prop Firm

With a multitude of prop firms available, choosing the right one can be daunting. Here are essential factors to consider:

- Reputation: Research the firm’s track record and reputation in the trading community. Reviews and testimonials can provide valuable insight.

- Profit Sharing Ratio: Understand the profit-sharing structure and ensure it aligns with your trading goals.

- Training and Support: Look for firms that offer robust training and support to facilitate your growth as a trader.

- Trading Conditions: Assess the trading conditions provided by the firm, including leverage, spread, and available trading instruments.

Conclusion

Forex trading prop firms represent an exciting avenue for traders seeking to maximize their potential without the immediate risk of personal capital loss. By offering access to substantial funds, training, and a supportive environment, prop firms can help traders of all levels develop their skills and succeed in the fast-paced world of forex trading. Nevertheless, it is essential to carefully weigh both the advantages and challenges before committing to a specific firm, ensuring it aligns with your trading aspirations and style. With the right approach and resources, traders can unlock a pathway to success in the forex market.

发表回复